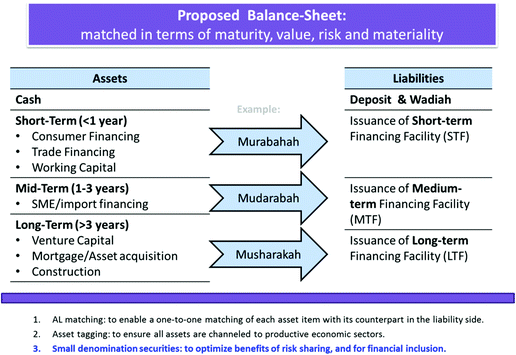

Time Value- Conventional banks earn their profits based on the time taken to repay the loan. Islamic banking products are usually asset backed and involves trading of assets renting of asset and participation on profit loss basis.

As such Islamic banks declare their profits on a monthly basis as part of their risk sharing scheme.

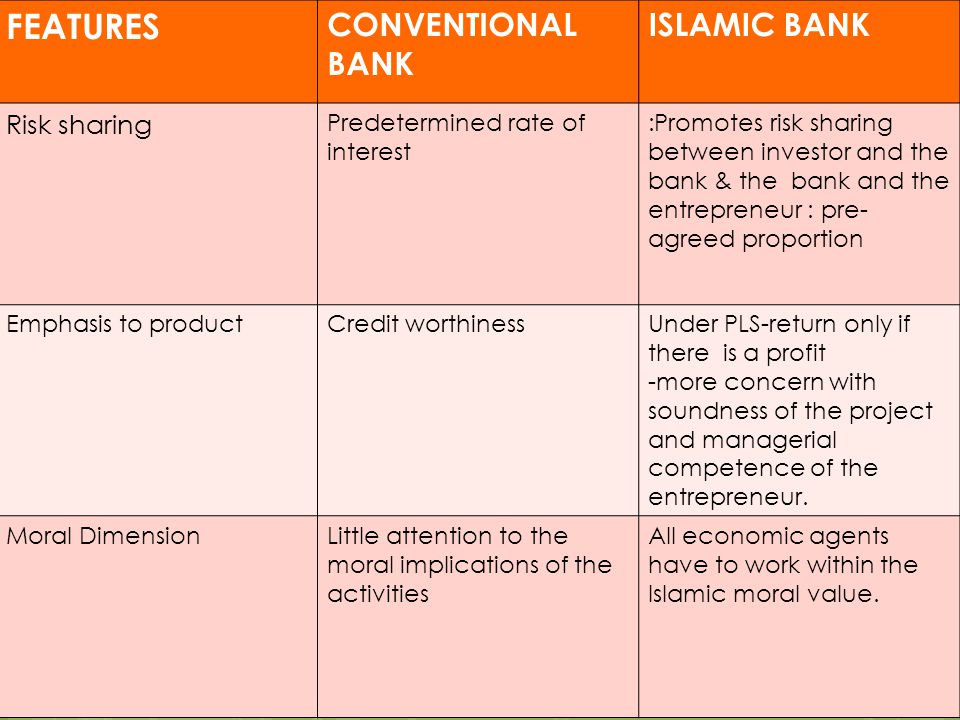

. Conventional Banking Conventional banks only have one mode of financing for its customers and that is Loan. In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. It is a participatory banking in capital and profit loss.

BASIC DIFFERENCES BETWEEN CONVENTIONAL AND ISLAMIC BANKING Modes of Finance. However Haron 1994 in his studies stated that about 100 per cent of the Muslim population and 75 percent of non-Muslims are aware about the existence of Islamic banking services in Malaysia and out of this only 63 percent understood the difference between Islamic banks and conventional banks. Money is a medium of exchange and one can use it to acquire assets and any other commodity allowed by Sharia Laws.

Differences Between Islamic Bank and Conventional By. An Islamic banking is not only banker but also a partner in business. The main difference is that Islamic Banking is based on Shariah foundation.

Increase the facility amount the Loan Facility Agreement would only need to be up-stamped. The bank does not have the responsibility of profitloss of the customer. This is because they are extremely different in many ways.

For Islamic financing a new Sale And Buy-back Agreement BBA needs to be drawn up making it more expensive. Real Asset is a product Money is just a medium of exchange. The key difference is that Islamic Banking is based on Shariah foundation.

In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. Conventional Bank treats money as a commodity and lend it against interest as its compensation. Relation of customer bank is of Creditor-Debtor.

Islamic Banks earn profits by exchanging goods and services. Ust Hj Zaharuddin Hj Abd Rahman One must refrain from making a direct comparison between Islamic banking and conventional banking apple to apple comparison. Concept of money.

Transactions- In conventional banking money is treated as a product whereas in Sharia banking your assets are the product and money is only a medium of exchange. Thus all dealing transactions business approach product feature investment focus responsibility are derived from the Shariah law which lead to the significant difference in many part of the operations the conventional banking. In conventional bank the relation between customer and banker is nothing but debtor and creditor.

Money is a product besides medium of exchange and store of value. As such Islamic banks declare their profits on a monthly basis as part of their risk sharing scheme. Major Differences Between Islamic and Conventional Banking.

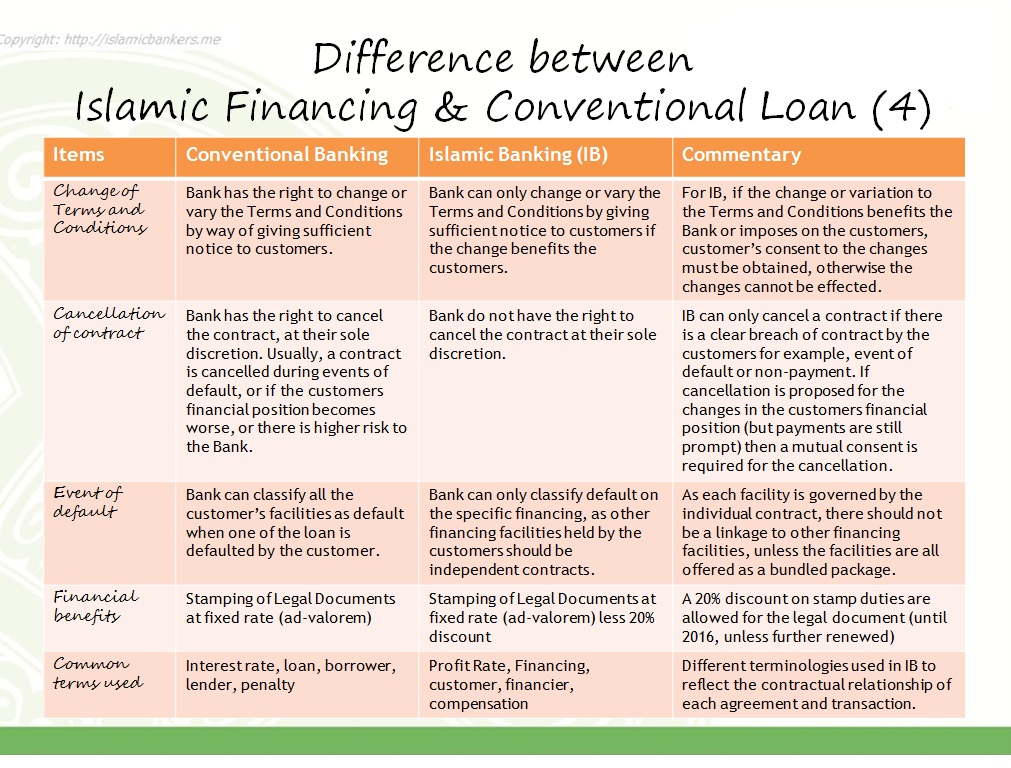

While both products will allow you as a consumer to receive the financing you require but the documentation and terminology used are differently. This is a simplified table to help you better understand the key differences between Islamic Personal Loan and Conventional Loan. They all can avail an array of products with an underlying mode of debt only.

Differences between Islamic Personal Loan Conventional Loan. As a summary below are some quick differences I have compiled from my earlier days in the industry on the differences between the models. Based on the Malaysian Islamic Banking Act 1983 Islamic banking is a comprehensive and value-based system that aims to respect and enhance the moral and material wellbeing of individuals and society in general Yahya et al 2012.

Benefits of Conventional Financing over Islamic Financing. Unlike Conventional Banks an Islamic Bank acts as an intermediary between the depositor and the entrepreneur. Bank Islam Malaysia Pte BIMB was the first Islamic bank Rosly and Abu Bakar 2003 and it was established in 1983.

It is true but there is more to it. Profit on exchange of goods services is the basis for earning. For Conventional loans if a borrower alters the terms of the finance Eg.

Unlike Conventional Banks an Islamic Bank acts as an intermediary between the depositor and the entrepreneur. Time value is the basis for charging interest on capital. Conventional banks are operating is interest in.

Be it an individual customer a business partnership or a corporate client. Islamic banking system that operates in parallel with the conventional banking. Bank Islam Malaysia Berhad BIMB was the first Islamic bank in Malaysia having been set up on 1 July 1983.

The key contrast is that conventional banks earn their money by charging premuim and expenses for administrarions while Islamic banks acquire their cash by profit and loss sharing exchanging renting charging expenses for administrations rendered and utilizing other sharia contracts of trade. Relationship of customer bank is of Seller- Buyer and. DNA OF ISLAMIC BANKS.

When you ask many people the main difference between an Islamic bank and a conventional bank the most probable answer is that the former does not charge interest. There really are differences between Islamic Banking and conventional banking and there are some of us trying very hard to make a difference in the compulsion towards Riba.

Difference Between Islamic Banking And Commercial Banking Features

Conventional Banking Islamic Bankers Resource Centre

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

Punitive Pricing Islamic Bankers Resource Centre

Pdf An Empirical Investigation Into The Problems And Challenges Facing Islamic Banking In Malaysia Semantic Scholar

Conventional Banking Islamic Bankers Resource Centre

Tips While Using Your Credit Card For Shopping Small Business Credit Cards Credit Card Management Miles Credit Card

Differences Between Conventional Hire Purchase And Islamic Hire Download Table

Differences Between Conventional And Islamic Microfinance Download Table

Pin On Islamic Banking Finance

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Routledge Focus On Economics And Finance The Malaysian Banking Industry Policies And Practices After The Asian Financial Cr In 2022 Banking Industry Banking Finance

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Conventional Banking Islamic Bankers Resource Centre

History Of Islamic Finance In Malaysia Springerlink

Difference Between Islamic Banking And Conventional Banking Aims Uk Youtube

Icb Islamic Bank Job Circular 2018 Job Circular Islamic Bank Bank Jobs

Pdf Research On Islamic Banking In Malaysia A Guide For Future Directions Ssrn Electronic Journal

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table